Some states honor the provisions of US. Apply for tax clearance letter by employer.

1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status.

. To find out more about DTAs see the role of double tax agreements. إسکندر مليسيا formerly known as Iskandar Development Region IDR. Tax Audit Framework Superceded by the Tax Audit Framework 01052017 - Refer Year 2017.

The 2018 labour productivity of Malaysia was measured at Int55360 per worker the third highest in ASEAN. Under EU rules each country still has a certain latitude to decide what percentage of your. ByrHasil For taxpayers to pay their income tax through appointed banks.

DTAs reduce tax impediments to cross-border trade and investment and assist tax administration. Agreement between the kingdom of Saudi Arabia and the Republic of Albania for the avoidance of double taxation and the prevention of tax evasion respect to taxes on income and on capital signed on 622019 and entered into force on 1122019. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

In particular non-resident companies that are subject to UK tax on UK-source rental profits see the Taxes on corporate income section for more information will find their letting agent or tenants are obligated to withhold the appropriate tax at source currently 20 without any allowances from their rental payments unless the recipient has. 1 January 1999 for taxes. The Agreement signed is a protocol of amendment that replaces the Savings Agreement between Switzerland and the European Union which has applied since.

Tax treaties and some states do not. Therefore you should consult the tax authorities of the state in which you live to find out if that state taxes the income of individuals and if so whether the tax applies to any of your income or whether your income tax treaty applies in the state in which you live. This section contains information about Irelands Double Taxation Agreements DTAs and Tax Information Exchange Agreements TIEAs.

Switzerland and the European Union EU signed an Agreement regarding the Introduction of the Global Automatic Exchange of Information Standard on 27 May 2015 applicable as of 1 January 2017. Restriction On Deductibility of Interest Section 140C Income Tax. Advance Pricing Arrangement.

This publication is the tenth edition of the full version of the OECD Model Tax Convention on Income and on Capital. E-Residence Apply for Certificate of Residence COR to confirm taxpayers resident status in Malaysia for tax purposes under the Double Taxation Agreement DTA. Tax Audit Framework On Withholding Tax available in Malay version only 01082015.

Mutual Agreement Procedure MAP Multilateral Instrument MLI Non-Resident. This full version contains the full text of the Model Tax Convention as it read on 21 November 2017 including the Articles Commentaries non-member economies positions the Recommendation of the OECD Council the historical notes and the. The Income Tax Department NEVER asks for your PIN numbers.

AGREEMENT FOR AVOIDANCE OF DOUBLE TAXATION AND PREVENTION OF FISCAL EVASION WITH AFGHANISTAN Whereas the Government of India and the Government of Afghanistan have concluded an. ولايه ڤمباڠونن إسکندر and South Johor Economic Region SJER is the main southern development corridor in Johor MalaysiaIt was established on 8 November 2006. The Double Taxation Agreement entered into force on 8 July 1998 and was amended by a protocol signed on 22 September 2009.

E-Data Praisi For employers to check and verify submitted prefill. According to the Global Competitiveness Report 2021 the Malaysian economy is the 25th most competitive country economy in the world. AmendFix Return Form 2848.

Tax Audit Framework On Finance and Insurance Superceded by the Tax Audit Framework On Finance and Insurance 18112020 - Refer Year 2020. New Zealand has a network of 40 DTAs in force with its main trading and investment partners. This status of fictitious tax-resident is granted by some countries to cross-border commuters.

Tax Information Exchange Agreement. The economy of Malaysia is the third largest in Southeast Asia and the 34th largest in the world in terms of GDP. New Zealand has DTAs and protocols in force with.

Countries enter into Double Tax Treaties to elim inate or mitigate the incidence of juridical double taxation and avoidance of fiscal evasion in the international trade or transactions. MOU on Article 27 Mutual Agreement. Turks and Caicos Islands - taxation of.

The complete texts of the following tax treaty documents are available in Adobe PDF format. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. A consolidated version of the 1993 UK-India Double Taxation Agreement as amended by the 2013 Protocol has.

Iskandar Malaysias development is guided by the Comprehensive. Apply for Power of Attorney Form W-7. Under some double tax treaties the country where you earn all or almost all of your income will treat you as tax-resident even if you dont live there.

6 April 2014 for Income Tax and Capital Gains Tax. The agreement is effective in Malaysia from. Date of Signing the Agreement Gazette Operative in Sri Lanka From the Year of Assessment.

African Congress Mission. Installment Agreement Request POPULAR FOR TAX PROS. The Double Taxation Dispute Resolution EU Revocation EU Exit Regulations 2020.

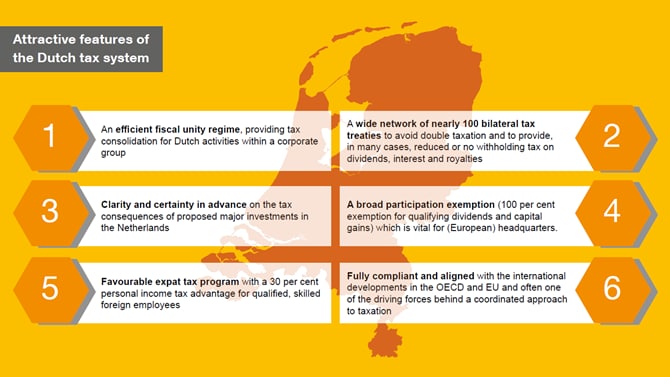

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Advantages Of Double Taxation Agreement Abc Of Money

Individual Income Tax In Malaysia For Expatriates

Double Taxation Agreements In Malaysia Acclime Malaysia

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Double Taxation Oveview Categories How To Avoid

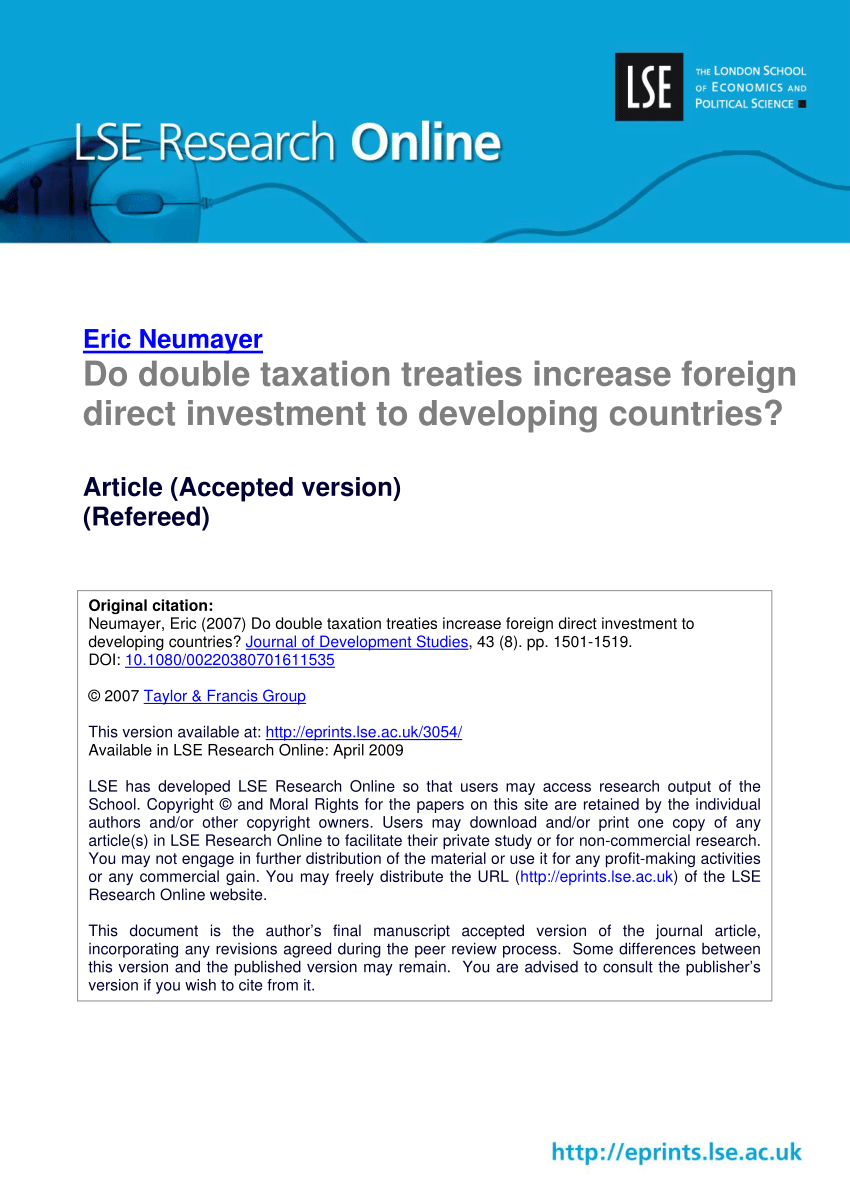

Pdf Do Double Taxation Treaties Increase Foreign Direct Investment To Developing Countries

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

How To Calculate Foreigner S Income Tax In China China Admissions

How To Get Relief In Case Of Double Taxation

France Denmark Double Tax Treaty Finally Signed By Both Countries

Explained Double Taxation Avoidance Agreement Dtaa Youtube

Double Taxation In Spain What Is It And How Does It Work

Different Types Of Income Tax Assessments Under The Income Tax Act

Pdf The Relationship Between Double Taxation Treaties And Foreign Direct Investment

Top 8 Countries With No Income Tax That You Should Know